Investing in a new roof and knowing when it’s time to pull the trigger can be challenging. We are here to help guide you through the decision making process and answer the three key questions: When is it time for a new roof? Who will you hire? And How will you pay for this darn thing!

1. When is it time for a new roof?

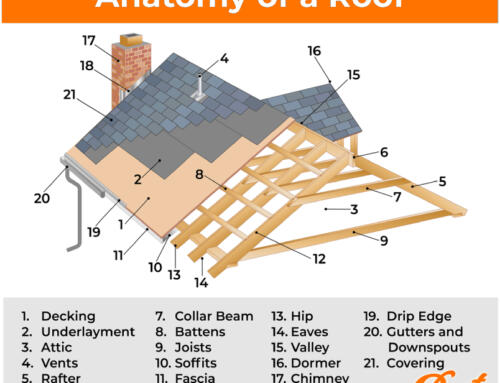

Older asphalt shingles tend to last around 20-30 years depending on manufacturer and climate. Proper ventilation will also play a role in the longevity of a shingle. Improperly ventilated roof systems can deteriorate well before the manufacturers listed life span. Other indicators include:

- Shingle granulates are building up in the gutters

- You are experiencing a leak

- Warping of the decking

- Hail damage in the neighborhood

- Shingles are at the 20-30 year mark

2. Who will you hire?

Pick us pick us! The truth is, do your research. Check the reviews, make sure you are comfortable with the company and they are LOCAL. You don’t want a storm chaser that is here one day and gone the next. The following list will help you research your potential roofing company before signing that contract.

- Check Yelp Reviews- Read a bunch, get a good picture of who they are.

- Check to see if the business is registered with the BBB

- Look at Google Reviews

- Get references from a supplier such as SPEC or ABC and a few homeowners.

- Ask for copies of liability insurance and Workman’s Comp.

- Verify they are a local company

3. How will you pay for your new roof?

If you can be proactive and get an estimate well ahead of time, great. That gives you a bit of breathing room to set aside the extra $$. Sometimes this is just not an option, your roof is leaking and you need a new roof asap. Here are a few financial options for roof replacement:

- Insurance Coverage: This will usually only cost you your deductible averaging around $2000. Other minor costs may incur, permit fees and selected upgrades may come into play.

- FHA Title I Home and Property Improvement Loan: You can borrow up to $25,000 and have up to 20 years to pay it off.

- Home Equity Loan: In most cases, you can borrow up to 85% of your home’s equity. Quick breakdown you have a house worth $400,000, you currently owe $330,000 your actual equity = $70,000 allowing you to borrow $59,500.

- Personal Loan: If you have decent credit your bank may extend you a personal loan for home improvements.

Give Mountain Reach Roofing and Gutters a call today to discuss your new roof replacement options. (720)-443-5386